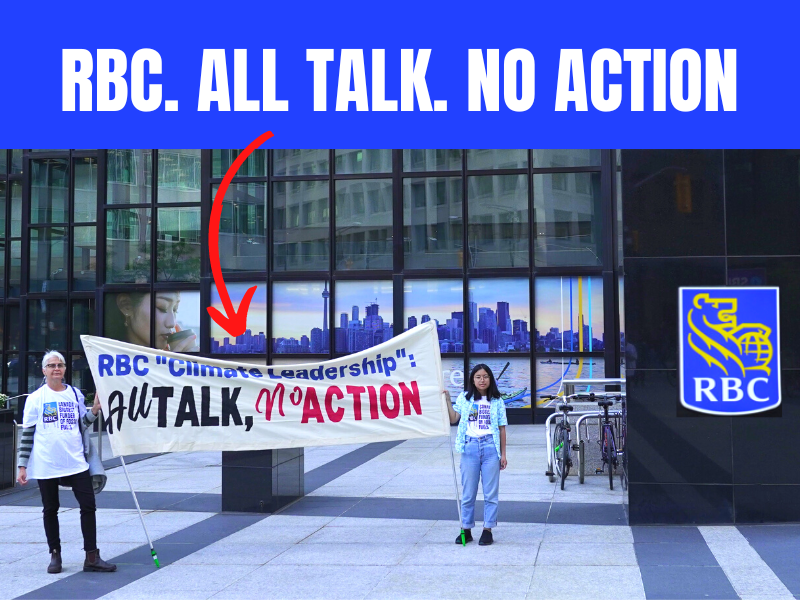

October 26, 2022 – Indigenous-led and environmental groups slammed today’s RBC 2030 climate targets as a “sham” that fails to meet government or science-aligned targets. The bank is currently under investigation by the Competition Bureau for allegedly misleading communities over its climate plans through advertising, or ‘greenwashing.’

A comparison to released plans by Canada’s other major banks shows RBC’s plan is less ambitious, falls well short of what’s needed for action on the climate crisis from Canada’s largest financier of fossil fuels and demonstrates a continued pattern of greenwashing by the bank.

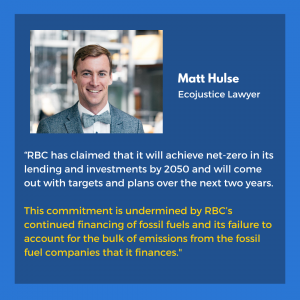

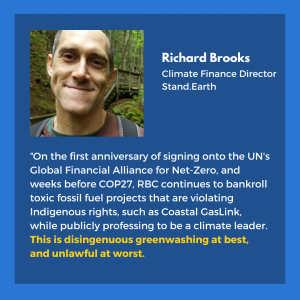

Unlike RBC’s competitor Bank of Montreal (BMO), RBC continues to rely on carbon intensity targets instead of absolute emission reduction targets for energy sector clients, which can be achieved even if overall emissions increase. RBC continues to evoke climate leadership while refusing to address their reality as the fifth largest financier of fossil fuels globally. There remains no timeline provided to phase out financing to the expansion of coal, oil, gas and tar sands while they continue to double down on support for projects including TC Energy and the Coastal Gaslink pipeline which violate Indigenous rights.

| Canadian banks’ climate targets |

|

Oil and gas (Scope 1 & 2) |

Oil and gas (Scope 3) |

| UN Race to Zero criteria |

50% reduction in absolute GHGs from financed, facilitated and insured activities by 2030. |

50% reduction in absolute GHGs from financed, facilitated and insured activities by 2030. |

| RBC |

35% reduction in emissions intensity (g CO2e/MJ) from financed operations by 2030 (relative to 2019). |

11-27% reduction in emissions intensity (g CO2e/MJ) by 2030 (relative to 2019). |

| BMO |

33% reduction in portfolio emissions intensity (tCO2e/TJ) from 2019 baseline by 2030. |

24% in absolute scope 3 emissions from 2019 levels by 2030. |

| CIBC |

35% reduction in emissions intensity (gCO2e/MJ) from 2020 levels by 2030. Includes carbon removal credits. |

27% reduction in emissions intensity (gCO2e/MJ) from 2020 levels by 2030. Includes carbon removal credits. |

| Scotiabank |

30% improvement in CO2e emissions intensity (tCO2e/TJ) from 2019 baseline by 2030. |

Scope 3 target won’t be set until 2023. |

| TD |

29% reduction in emissions intensity (gCO2e/CAD $) for scopes 1-3 from 2019 baseline by 2030. Note: TD is the only bank to use an emissions/dollar metric. |

29% reduction in emissions intensity (gCO2e/CAD $) for scopes 1-3 from 2019 baseline by 2030. |

| Source: Greenpeace Canada’s August 2022 Racing to Zero? report & RBC’s Net Zero Report (released today). |

Representatives of Indigenous-led and environmental organizations, including signatories to a recent open letter to RBC CEO Dave McKay, provide the following reactions to today’s announcement and are available for interviews:

“RBC has been instrumental in the destruction of our lands by financing the Coastal Gaslink Pipeline, which is illegally now drilling into our pristine lands and threatening our waterways. While RBC claims it’s saving the planet, we’re here defending our yintah and Wedzin Kwa. Coastal GasLink would emit the equivalent of every car in so-called Canada. Today’s announcement does nothing to stop RBC’s financing of fossil fuel projects destroying Indigenous lands.” Chief Woos, Wet’suwet’en Hereditary Chief

“It’s hard to see RBC as a climate leader when they are funding the destruction of our homelands with pipelines that have been forced upon us without our Free Prior and Informed Consent.” Kukpi7 Judy Wilson, Secretary-Treasurer of the UBCIC

“There’s a dictionary-official definition for RBC’s climate targets: it’s called greenwashing. With RBC continuing to bankroll polluters, these pledges are just more smoke and mirrors. While people across Canada bear the brunt of fires, floods, and deadly heat, Canada’s #1 fossil fuel-financing bank continues to pour gas on the flames, bankrolling gas, tar sands, oil, and coal. Instead of financing Indigenous rights-violating fracked gas pipelines, RBC has the opportunity to reinvest in climate-safe solutions and truly live into its climate rhetoric.” Richard Brooks, Stand.earth Climate Finance Program Director

“RBC is dragging its feet on climate while positioning itself as climate leaders and advocates for youth futures. The bank has poured hundreds of millions into student initiatives and ‘green tech innovation’ challenges to mask the harm they continue to cause by funding fossil fuel expansion. It’s disheartening to see them position themselves as advocates for young people and then do the bare minimum on climate action.” Evelyn Austin, a youth organiser with Banking on a Better Future

“Families across Canada face an uncertain future and increasing impacts of climate chaos. Meanwhile, RBC continues to pour money into oil and gas projects that add to that crisis and violate Indigenous rights, instead of living up to its claim to support youth and a greener future. Kids need a safe, just, and liveable future. If RBC is committed to that, it can’t continue to support the fossil fuel industry.” Jennifer Roberge, Organizer with For Our Kids Montreal and complainant in the RBC Competition Bureau investigation

Quick facts:

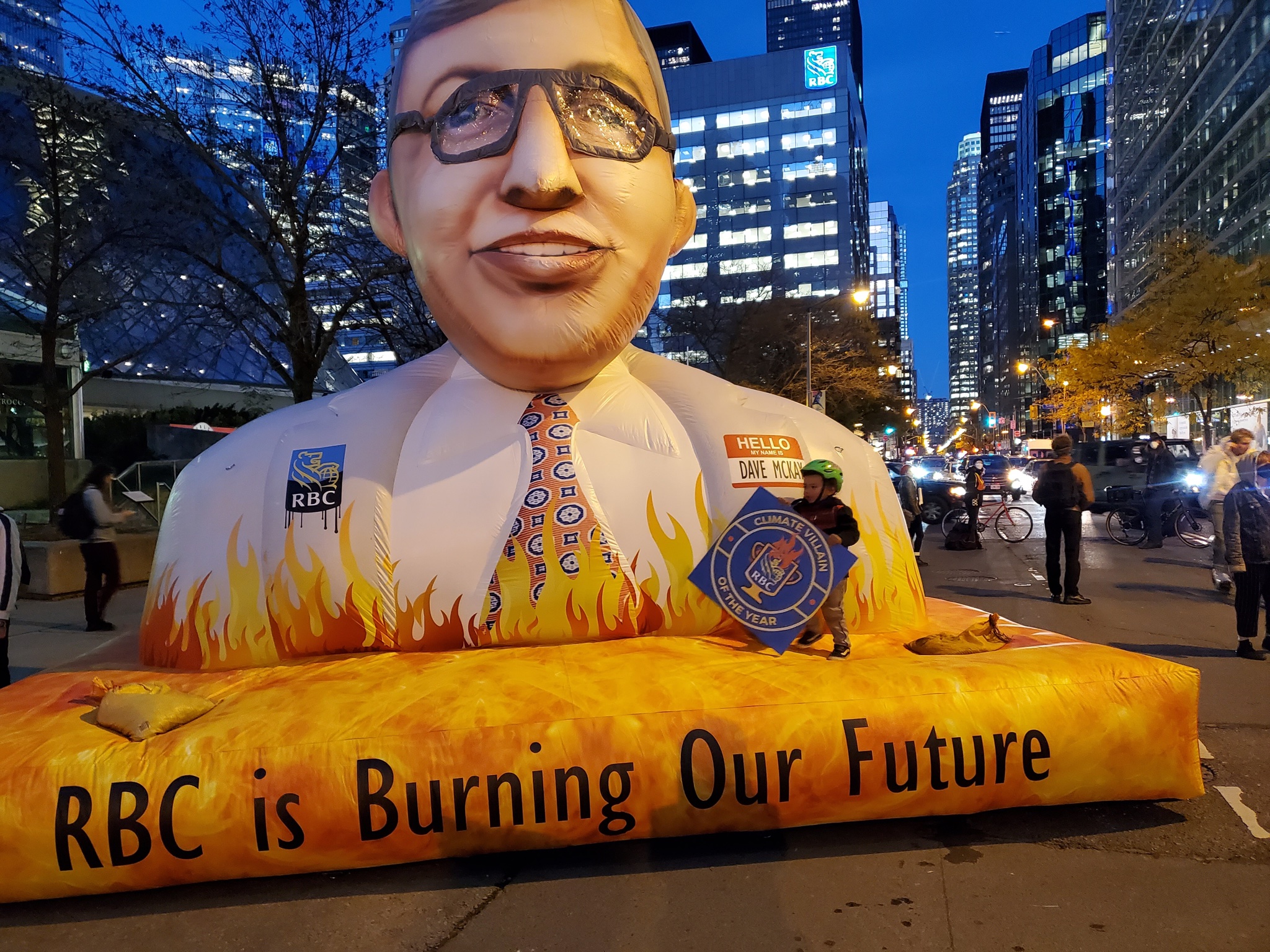

- RBC CEO Dave McKay was called on by 19 organisations supported by over 2 million people in a recent open letter, to commit to a credible pathway to achieving net-zero – a 50% absolute emissions reduction target covering all aspects of RBC’s business including scope 1, 2, and scope 3 emissions, which includes financed emissions, by 2030. This is consistent with the International Energy Agency’s Net Zero Emissions by 2050 Scenario (NZE) based on a pathway towards limiting the global temperature rise to 1.5°C which requires ‘a huge decline in the use of fossil fuels.’ The letter further calls for leadership on climate and Indigenous rights including a timeline to phase out financing the expansion of coal, oil, gas, tar sands, and projects that violate Indigenous rights, and severing ties with TC Energy and Coastal GasLink.

- RBC joined the Mark Carney-led Glasgow Financial Alliance for Net-Zero (GFANZ) in October 2021, promising to align the bank’s lending and investment portfolios with a science-based pathway to net zero by 2050. Membership in the now 500+-strong GFANZ was a condition to access COP26 negotiations in Glasgow, Scotland. Now, ahead of COP27, RBC and Canadian banks risk getting booted from the global network as they push back against the global financial sector setting standards for climate risk, revealing the bank’s playbook of delay and deceit on climate action.

- Bank counterparts in Europe are consistently taking more leadership in responding to the climate crisis. Just last week, Deutsche Bank, French bank SocGen, and the UK’s Lloyds all released absolute emissions targets for oil and gas clients. Citibank, the world’s second largest fossil fuel financier, also set an absolute target for its energy sector clients of 29% by 2030. BBVA, a major Spanish bank, recently announced that it would no longer finance new projects related to oil and gas exploration, drilling and extraction. It is working with oil and gas clients in its credit portfolio with the aim to reduce their global carbon emissions by 30% by 2030 and aligning its exposure to the oil and gas sector in accordance with a 2050 net zero emissions target.

- RBC competitor Bank of Montreal (BMO) is currently the only major Canadian bank to have set absolute emissions reduction targets for its energy sector clients — 24% by 2030, which is still below what is required to achieve net zero by 2050.

- RBC’s goals also fail to meet the bar set by the Canadian government for emissions reductions by 2030 (e.g. a 42% reduction in absolute emissions from oil and gas by 2030).

-30-

For more information:

Kari Vierimaa

KPW Comms

416.578.0488

kari@kpwcomms.com