HSBC to Phase out Oil and Gas finance – huge win

Thanks to pressure from thousands of people, UK banking giant HSBC is going to stop lending money to new fossil fuel fields, anywhere in the world. That means that any fossil fuel company that wants to drill for new oil, or dig for new gas, will not get a loan for it from HSBC. HSBC is the biggest bank so far to create a climate policy that restricts oil and gas funding.

Why does this matter?

This is a really big deal for a few reasons:

- HSBC lends billions of dollars to the world’s biggest fossil fuel companies. This new announcement won’t stop all of that money, but it’s the first huge step in getting HSBC to wind down the cash they’re dishing out to fossil fuel companies.

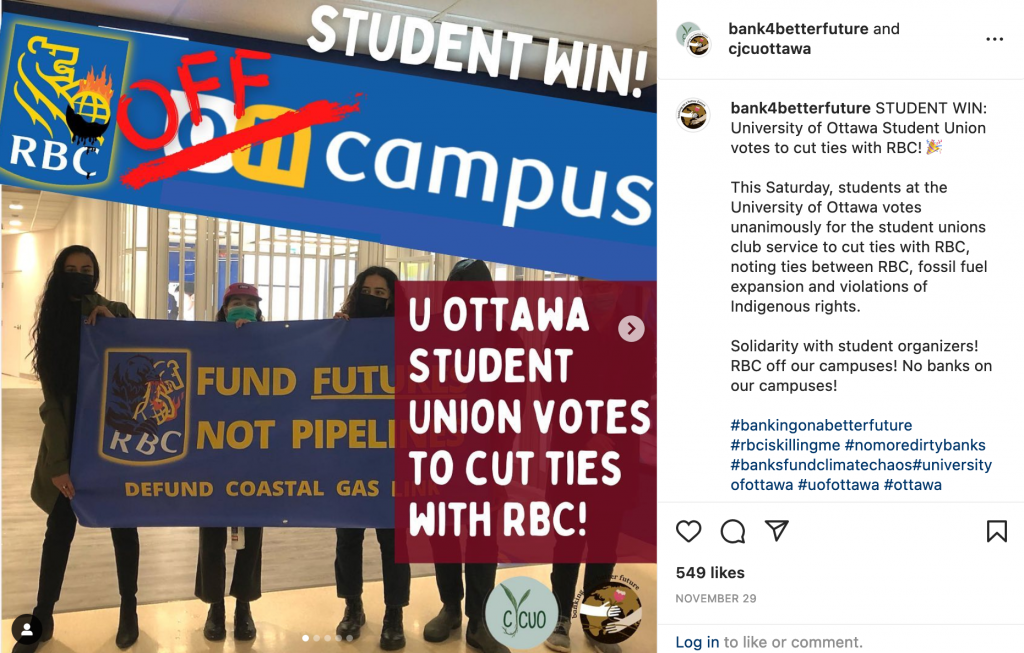

- HSBC is the first in the pack of major global banks to take this step. That means all the other major banks can see that it’s possible to stop funding new fossil fuel fields if they decide to. Now that HSBC is doing it, there’s no excuse for the likes of Barclays, Citi and RBC.

- Fossil fuel execs will be quaking in their weird crocodile-skin boots. Because once one bank starts taking away the pocket money they need to dig for new fossil fuels, other banks might just follow. And that would put them in a real pickle.

- And most importantly, it shows that we’re winning. It shows that pressure is working. It shows that together we can drag the world’s biggest businesses, kicking and screaming, to do the right thing. The job isn’t done. But now we know we have the tools to do it.

How did this happen?

How long have you got? Put simply, too many of us told HSBC that they can’t continue funding fossil fuels, and this announcement is a major sign that it’s working. Thousands of us on the outside (think activists, journalists, ordinary people) and inside (think staff & shareholders) made sure we were around every corner HSBC tried to walk down.

For example, *takes big breath*, the movement got HSBC found guilty of greenwashing by the UK ads regulator for misleadingly green adverts. Exposed them in the press for sending “sustainable” money to oil and gas. Pressured them to stop funding Putin’s fossil fuels in Russia when the war started. Set up a meeting for HSBC to meet the land defenders fighting against fracking projects funded by HSBC. Secretly surveyed tonnes of HSBC staff on HSBC’s fossil fuel funding, then released the anonymous results. Disrupted their AGM with non-stop singing. Got their shareholders to demand (and win!) climate action from HSBC. Hung out outside HSBC HQ to let staff know about HSBC’s fossil fuel funding.

Oh, and got their Head of Responsible Investment fired for saying “Who cares if Miami is 6ft underwater”.

Phew.

Plenty of room for improvement on oil and gas

This HSBC’s announcement is just the start. It’s not perfect by any means. The policy rules out funding for new oil and gas fields. It doesn’t rule out money for oil and gas companies. So if Saudi Aramco (the world’s worst fossil fuel company and HSBC’s BFF) wanted to spend $10 billion exploring for new oil, they now shouldn’t be able to get the money from HSBC. However if Saudi Aramco asked for $10 billion to help them grow their business, HSBC can loan it to them.

Essentially, HSBC is failing to rule out loans to oil and gas companies, at a corporate level, that are still exploring and extracting new oil and gas. This goes completely against the science. The IEA (a group of very qualified energy nerds) said last year that there can be no new oil and gas extracted if we want to keep to a safe world.

There’s also other banks. No other major global bank has made a commitment like this. And they should be struggling to catch up. We’re now pressuring the likes of Barclays, RBC and Citi to pull their socks up and end funding for fossil fuels.

HSBC wouldn’t be ending funding for new oil and gas without thousands of us pushing them to do it. And now, together, we’re making sure all fossil fuel banks do the same.