Critical Issue Overlooked in Consultation on Proposed Acquisition of HSBC by RBC

The following letter was sent to the Competition Bureau.

We are writing in regards to the Request For Information (RFI) the Competition Bureau opened on May 1, 2023 about the proposed acquisition of HSBC Bank of Canada by RBC. This transaction is an issue the undersigned groups are paying close attention to, and we urge the Bureau to reject the acquisition after considering the consequences for efforts to mitigate climate change and the availability of sustainable financial options for consumers.

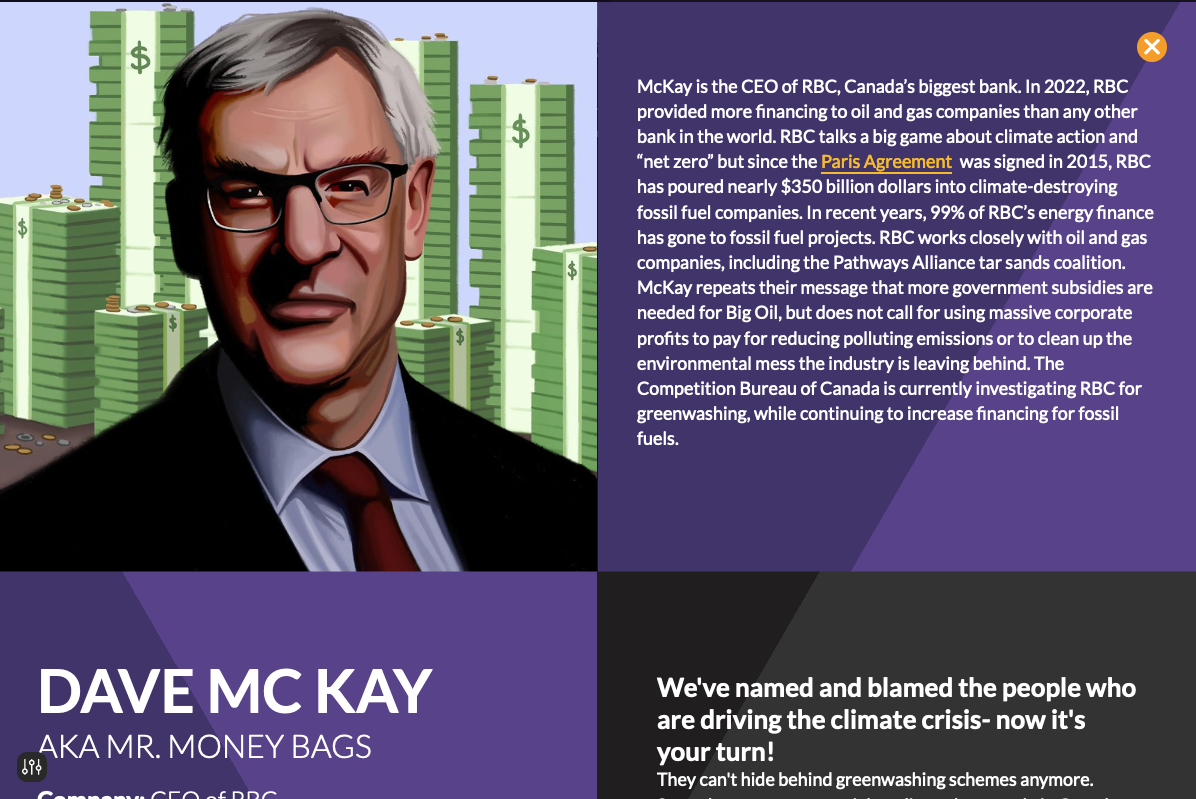

We applaud recent moves by the Competition Bureau to address the issues of misleading climate and environmental claims in advertising, aka greenwashing. Commissioner Boswell recently stated the “Bureau’s job is to protect the integrity of the marketplace, and that includes consumer confidence in the green economy.” The three current investigations the Bureau has opened relating to deceptive green marketing practices – including on RBC – are proof of this priority.

So while your RFI consultation rightly centres on issues of personal and business financial services in Canada’s highly concentrated banking sector, we believe you are missing a fundamental concern with this proposed transaction that can’t be overlooked.

RBC has a significant negative impact on our climate due to their ongoing financing of high emitting companies. RBC has financed over C$340 B in fossil fuels since the Paris Climate Agreement was signed, and in 2022 became the world’s #1 financial backer of fossil fuels. RBC has set only “emissions intensity” targets for 2030, which will allow its total financed emissions to rise. When challenged on its climate record it touts billions set aside for “sustainable finance,” but RBC deemed a $1B Enbridge oil sands pipeline loan sustainable, and a 2023 report shows RBC puts $99 of its energy finance into fossil fuels for every $1 in renewable energy.

RBC’s track record is relevant in comparison to that of HSBC Canada, a bank which has taken action to deliver on its sustainability commitments. HSBC helped issue Canada’s first green bond, had many corporate clients who valued sustainability, and consistently ranked higher than RBC in Corporate Knights Corporate Citizenship rankings. In 2022, HSBC announced a precedent setting policy to stop financing new oil and gas projects, which, while imperfect, was welcomed by UK NGOs. Importantly for your consideration, RBC had that climate policy exempted from HSBC Canada as a condition for the takeover in question. In 2022 HSBC’s global fossil fuel financing went down, and will continue to do so based on commitments made at the time, while RBC’s went up, making RBC the top global banker of fossil fuels.

Despite claims to be Net Zero by 2050 and to support clients in the energy transition, RBC’s business practices show it has no intention of cutting its financing of fossil fuels. Both the UN and International Energy Agency agree we must cut our climate emissions in half by 2030, and that there is no room in a Net Zero 2050 scenario for any new fossil fuel development. The UN Secretary General states “we must have zero tolerance for net-zero greenwashing.”

If RBC takes over the greener HSBC Canada it will remove sustainable choices from the marketplace. In a world where consumers and citizens increasingly make decisions based upon the climate impact of the products and services they consume, the loss of competitive pressure to improve climate and environmental performance in financial services is a growing problem.

Further, the loss of a competitor moving to phase down its support for fossil fuels to one that is increasing it will serve to further consolidate Canadian investment into an area at risk of becoming stranded, worsening the level of climate risk in our national economy.

There are numerous other reasons to reject this proposed transaction due to its negative impacts on mortgage rates, affordable housing and cost of living. RBC has also demonstrated significant cases of mistreatment of Indigenous Peoples and lacks meaningful policies to address the Free, Prior, and Informed Consent of Indigenous Peoples.

Commissioner Boswell has publicly stated that “climate change may be the greatest market failure we have faced.” We therefore urge you to consider the impacts of this proposed acquisition on diminished competitive pressure on green financial choices and increased climate risk, and to reject the proposed acquisition of HSBC Canada by RBC.

Sincerely,

- Environmental Defence Canada

- Stand.Earth

- LeadNow

- Climate Action Network Canada

- Banking on a Better Future

- Friends of the Earth Canada

- For Our Kids

- Re_Generation

- 350.org Canada

- Coalition Sortons la Caisse du Carbone

- Decolonial Solidarity

- Gidim’ten Checkpoint

- West Coast Environmental Law

- Shift: Action for Pension Health and Planet Wealth

Representing over 1,325,000 Canadian supporters

The above letter was delivered to the head of the Competition Bureau, as well as submitted to the Minister of Finance and Minister for Climate Change and Environment on May 25, 2023.