Barclays Bank ditches Canadian oilsands finance

Yesterday, Barclays, Europe’s largest financier of tar sands companies, announced its commitment to end financing of tar sands producers, as well as ban further financing of new oil sands pipelines. This particularly impacts Canadian companies like Canadian Natural Resources, Cenovus, MEG Energy, TC Energy amongst others. Barclays pumped more than $4.3 billion into tar sands companies since the Paris Climate Agreement was signed in 2016, making it the seventh largest financier of the sector.

The announcement was part of an update of fossil finance policies by Barclays in the UK. While the overall policy was disappointing to European climate activists, the oil sands exclusion stood out. The phase out was covered in Reuters, in multiple sustainable business and ESG publications. It was also widely reported in oil industry publications, and in Alberta including CBC Calgary TV.

On this latest announcement, Stand.earth leaders, working to transition Canada’s economy off fossil fuels to a climate-safe economy, issued the following statements:

Richard Brooks, Climate Finance Director with Stand.earth said:

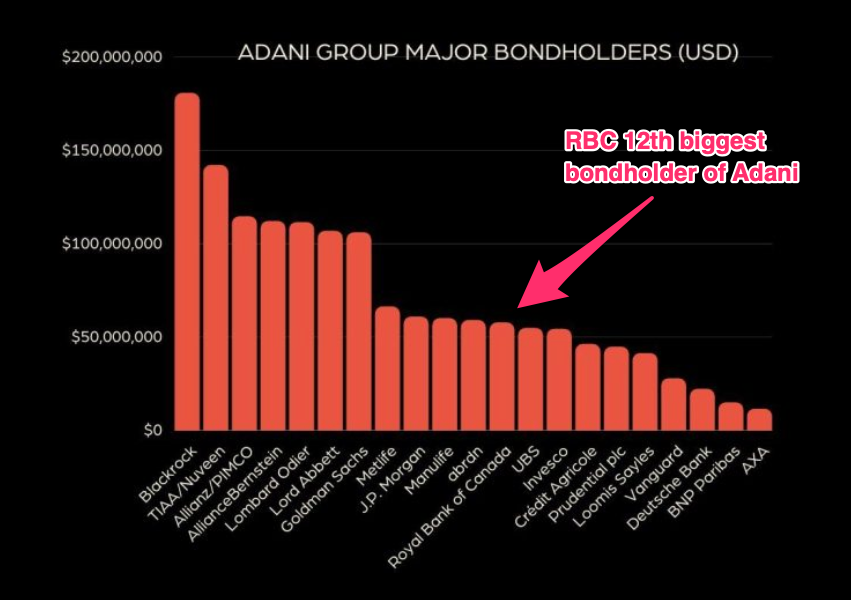

“Another day, another international bank ditching the world’s dirtiest fossil fuels, walking away from Canadian companies refusing to transition to a clean energy future. This time, the world’s largest funder of tar sands. Yet Canadian banks, led by the Royal Bank of Canada, refuse to act on the writing on the wall and are doubling down on financing tar sands. Concerned investors should take note in the lead up to the bank’s annual shareholder meeting April 5th and vote for our climate.”

Sven Biggs, Canadian Oil and Gas Director commented:

“Oil and gas extraction is Canada’s largest and fastest growing source of climate pollution. Today’s announcement from Barclays is a clear signal that the global financial sector is not going to stand by and allow companies like Canadian Natural Resources to continue to threaten our climate.”

In contrast to Barclays, the Royal Bank of Canada, the fifth largest financier of fossil fuels globally, increased financing of tar sands companies in 2022, affirming that Canadian banks are becoming the sector’s banks of last resort. RBC is facing numerous climate-related resolutions filed for voting at its annual shareholder meeting on April 5, which was moved to Saskatoon this year. This includes a resolution filed by the New York City Comptroller on behalf of its $242 billion pension funds, calling on the bank to set absolute emission reduction targets.

RBC is currently under investigation by the Competition Bureau of Canada for allegedly misleading consumers with its climate related advertising while continuing to finance coal, oil and gas so heavily.

More information on the Barclays announcement, including commentary by Shareaction that lead engagement with Barclays on its new climate policy, can be found here.