RBC under investigation by Competition Bureau for greenwashing

RBC is now under investigation for alleged misleading advertising related to the bank’s commitments on climate action while continuing to finance fossil fuel development, Canada’s Competition Bureau has confirmed.

The Competition Bureau is a federal law enforcement agency that rules on matters related to competition including advertising. The investigation was triggered by a complaint filed last spring by 6 members of the public, many of whom are clients or shareholders of RBC and supported by Ecojustice.

The story has been widely covered, in Canada and around the world:

- Globe and Mail: Competition Bureau launches inquiry into RBC’s green advertising

- Yahoo! Finance: RBC under investigation by Competition Bureau over climate claims

- Financial Post: Competition Bureau opens investigation into RBC over climate claims

- National Observer: RBC under investigation by Competition Bureau over alleged greenwashing

- Reuters: Canada’s watchdog launches investigation into RBC over climate complaints

From the Yahoo! Finance story:

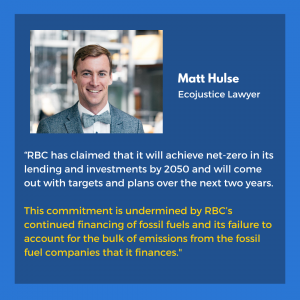

Ecojustice lawyer Matt Hulse says RBC’s ongoing dealings in the oil and gas industry are at odds with its stated climate strategy.

“RBC has claimed that it will achieve net-zero in its lending and investments by 2050 and will come out with targets and plans over the next two years,” he said in an emailed statement. “This commitment is undermined by RBC’s continued financing of fossil fuels and its failure to account for the bulk of emissions from the fossil fuel companies that it finances.”

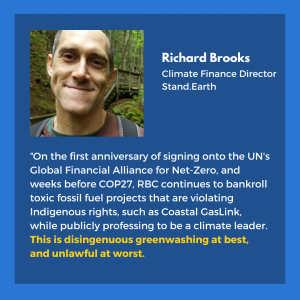

According to Ecojustice, RBC’s financing of fossil fuel companies in 2021 topped $34.4 billion in loans and underwriting, and included $50.4 billion in investments. In October of that year, RBC became a member of the UN-backed Net-Zero Banking Alliance, a commitment to align lending and investment practices with achieving net-zero emissions by 2050.

You can help by reading and sharing these posts from Ecojustice and Stand, as well as key media coverage above. You can find downloadable graphics and sample text for social media posts here: TOOLKIT

Below are shareable graphics you can also use.