Today, Indigenous land defenders, climate organizers, and communities brought a clear message straight to Royal Bank of Canada executives at the annual Canadian PGA Open: end fossil fuel finance and invest in a climate-safe future.

Photos and videos available here.

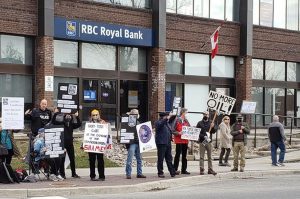

Dozens of participants gathered outside of the Open with billboards reading “RBC is Canada’s biggest funder of fossil fuels,” “RBC finances climate destruction,” “RBC finances Indigenous rights violations,” and more. Communities distributed flyers about RBC’s fossil fuel finance to spectators as they entered the Open, and an electric truck broadcasting videos of actor and activist Mark Ruffalo calling on RBC CEO Dave McKay to end fossil fuel finance is on-site all day today.

While floods, fires, deadly heat and pollution endanger the lives and livelihoods of communities across Canada and around the world, the Royal Bank of Canada continues to bankroll the fuel for the fire. RBC is Canada’s #1 fossil bank and the fifth worst funder of fossil fuels in the world, financing coal, tar sands, oil and gas to the tune of $262 billion since the Paris Climate Agreement was signed in 2016.

As RBC greenwashes its climate commitments and touts Indigenous reconciliation rhetoric, the bank is financing toxic fossil fuel expansion projects around the world that our climate cannot afford: from Coastal GasLink and Alberta tar sands, to the East African Crude Oil and TransMountain pipelines – carbon bombs set to trigger catastrophic climate breakdown while trampling Indigenous and local community rights.

In the face of the climate crisis UN Secretary-General António Guterres recently told the world “investing in new fossil fuels infrastructure is moral and economic madness.” Yet nothing seems to stop RBC from pouring more fuel on the fire.

“RBC holding a golf tournament while the RCMP harass and surveill First Nations leaders is corporate colonialism at its finest. Every single one of us has a responsibility to rise in solidarity with the Indigenous land defenders, and demand RBC stop financing this destruction,” said Sarah Beuhler, Stand.earth Climate Finance Campaigner.

RBC is increasing financing of the dirtiest fossil fuel – tar sands; quietly bankrolling the TransMountain Pipeline; and abetting the world’s longest proposed oil pipeline in East Africa.

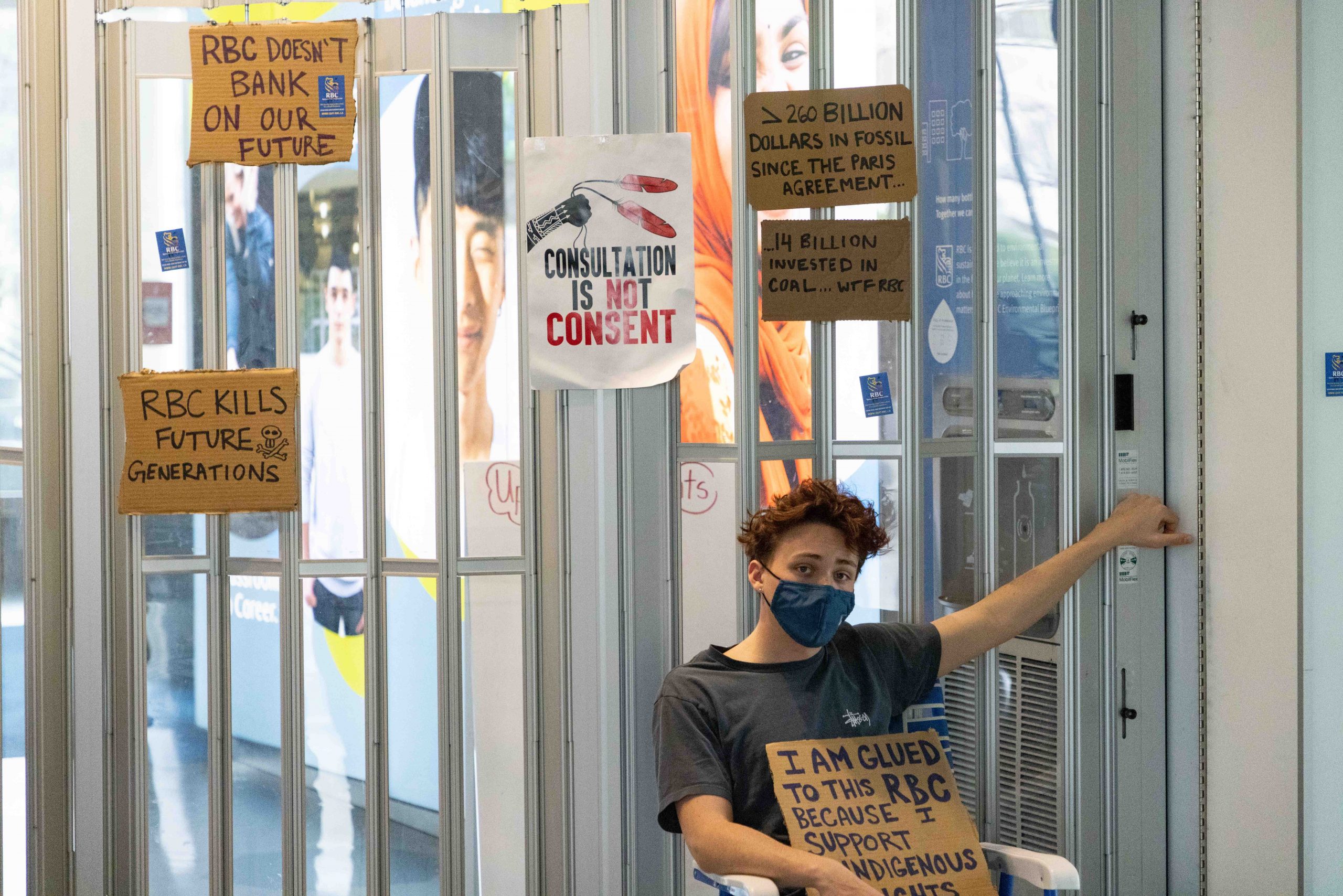

Right now in so-called British Columbia, Canada, Wet’suwet’en Hereditary Chiefs and Indigenous land defenders face a stand-off with the RBC-financed Coastal GasLink (CGL) pipeline and escalating police harassment, surveillance, and brutality on the territory. The project violates Wet’suwet’en rights and title, and lacks consent of Wet’suwet’en Hereditary chiefs, who have been resisting the project for a decade.

Royal Bank of Canada is the CAD $6.6 billion project’s financial advisor, with 26 banks providing additional financing. The UN Committee on the Elimination of Racial Discrimination (UNCERD) recently issued its third rebuke to British Columbia and Canada, calling for a withdrawal of police, and to stop the forced eviction of Wet’suwet’en people.

“RBC has the opportunity to truly live up to its shiny reputation of reconciliation and meaningful climate action,” Beuhler added. “That means stopping the Coastal GasLink pipeline, ending fossil fuel finance, and reinvesting in a climate-safe economy.”

There’s a growing and powerful movement rising in solidarity with Indigenous land defenders. Last month, members of the public submitted a Competition Bureau complaint, demanding an investigation into RBC’s misleading advertising about the company’s commitments to climate action while continuing to finance fossil fuel expansion.

Over 65+ Hollywood celebrities, hundreds international justice organizations, and thousands of communities demanding RBC end fossil fuel finance. Communities are preparing to organize around the full week of the June 6-12 RBC-sponsored PGA Canadian Open.

RBC has the opportunity to truly live up to its shiny reputation of corporate purpose, Indigenous reconciliation and meaningful climate action. That means stopping funding the expansion of fossil fuels, the Coastal GasLink pipeline, and reinvesting in a climate-safe economy and just transition for oil and gas workers and communities.

See original press release on Stand.earth website. Sent from the territories of Indigenous peoples including Ho-de-no-sau-nee-ga (Haudenosaunee), Anishinabewaki ᐊᓂᔑᓈᐯᐗᑭ, Mississaugas of the Credit First Nation, Mississauga, Wendake-Nionwentsïo, so-called Toronto, Ontario, Canada —