How Enbridge and RBC fake sustainability

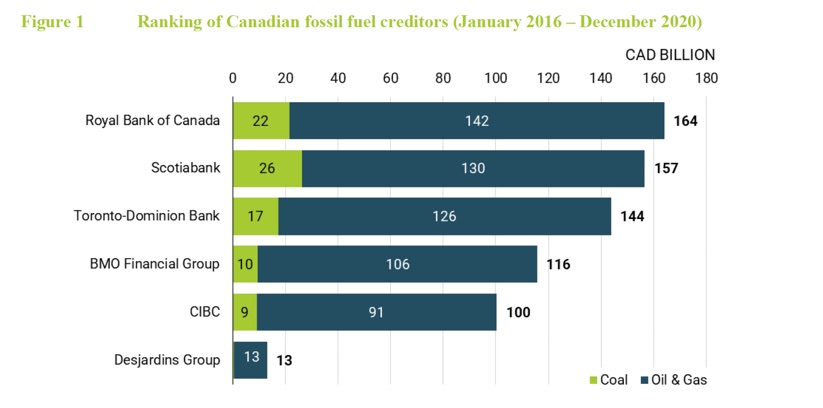

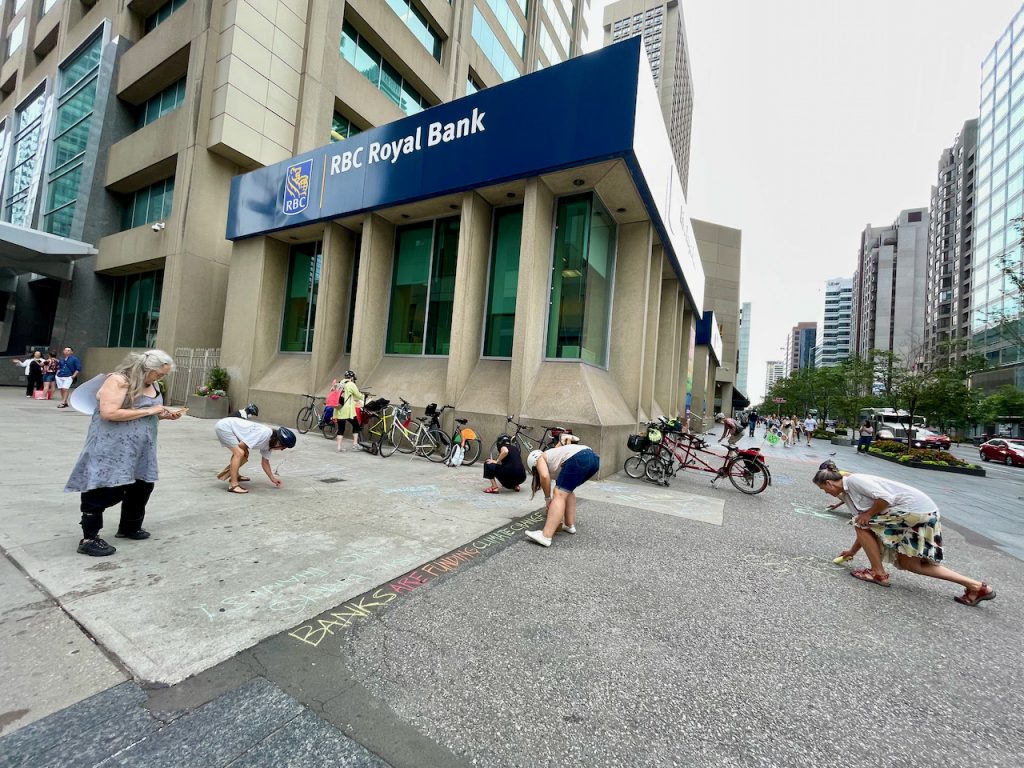

The Toronto Star reported today that RBC is one of many banks who are backing tar sands pipeline company Enbridge with “sustainability” linked loans. Yes this is the same Enbridge which is trying to build Line 3, a tar sands pipeline that heavily violates Indigenous rights.

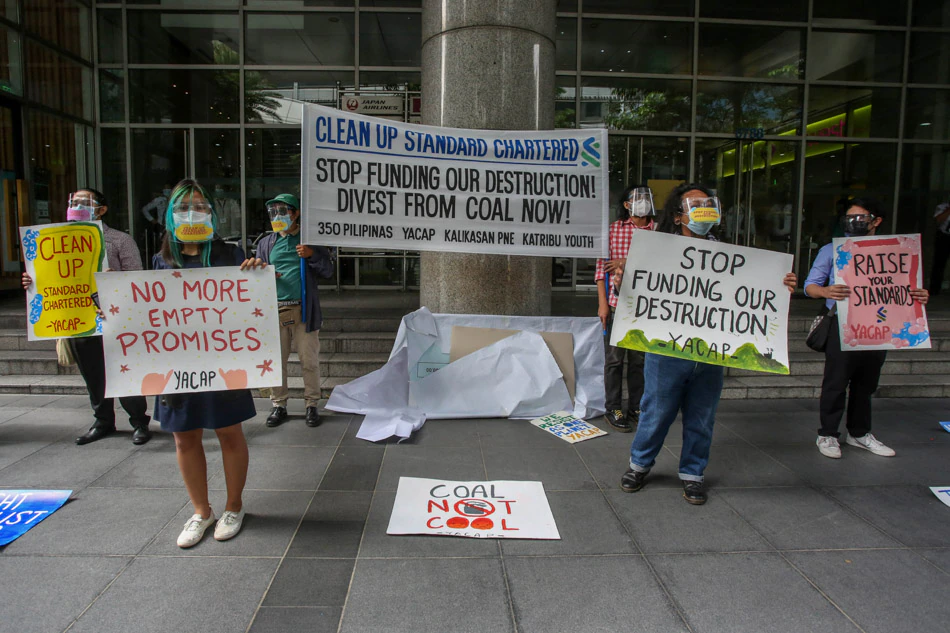

These kind of accounting and PR tricks are why when banks boast about the billions they plan on spending on “green transition” projects, you need to keep a skeptical eye.

Canada’s largest banks have signed a new deal to pump $1.5 billion into Enbridge that will help the oil and gas company expand its pipeline network, with the vast majority of that money referred to as “sustainability linked” in the term sheets.

The funds are going towards Enbridge’s general business, and are deemed “sustainable” because of Enbridge’s long term pledges to reduce emissions intensity, add diversity to its board, and become a “Net Zero” company by 2050.

Stand.Earth’s Richard Brooks and Giniw Collective’s Tara Houska helped cut through the greenwash:

Brooks called Enbridge’s commitment to reduce emission intensity as part of its ESG goals a “slap in the face” because the goal only addresses the emissions the company is directly responsible for, without including the emissions created when the fossil fuels are ultimately burned.

The problem is “in the product they are going to be shipping, and facilitating the expanded use of, which in the case of Line 3 is tarsands oil,” he said. “They’re building out infrastructure whose lifespan is decades, (and) once we build, we’re basically locking in their usage for many years to come.”

Tara Houska with the Giniw Collective, an Indigenous-led organization leading the protests against Line 3, called it greenwashing to say the bank loans are linked to sustainability.

“I don’t think there’s any way you can try to paint a tarsands company as sustainable,” she said. “The product they’re pulling out of the earth is one of the most carbon-intensive processes to create oil in the entire world.”

“Canada has been one of those places where, because the industry is so deeply entrenched with the government and with the financial sector, it’s been really difficult to gain any traction,” she said.

“But I hope Canadians pay attention to that and think about how their financial sector –– and that their banks –– are just as entrenched with the fossil fuel industry as their government is, which is outright buying pipelines these days.”

Read the full article on the Toronto Star website.

The new report is based on an analysis of 20 fossil fuel projects that have been stopped or delayed in the past 10 years due to Indigenous communities resisting across what is currently called the United States and Canada. Given the current climate crisis, Indigenous peoples are demonstrating that the assertion of Indigneous Rights not only upholds a higher moral standard, but provides a crucial path to confronting climate change head-on and reducing emissions.

The new report is based on an analysis of 20 fossil fuel projects that have been stopped or delayed in the past 10 years due to Indigenous communities resisting across what is currently called the United States and Canada. Given the current climate crisis, Indigenous peoples are demonstrating that the assertion of Indigneous Rights not only upholds a higher moral standard, but provides a crucial path to confronting climate change head-on and reducing emissions.