RBC is Canada’s biggest backer of toxic Adani bonds

One of the biggest business stories of 2023 has been the collapse in value of India’s Adani Group, and the wealth of its CEO Guatam Adani, after accusations of fraud.

The Adani Group has been accused of pulling “the largest con in corporate history” in short seller Hindenburg’s new report. Pension funds, asset owners, insurers and banks that have long been funding Adani’s coal expansion are losing trust and starting to drop the risky group.

Why can’t investors and banks spot the risks at Adani?

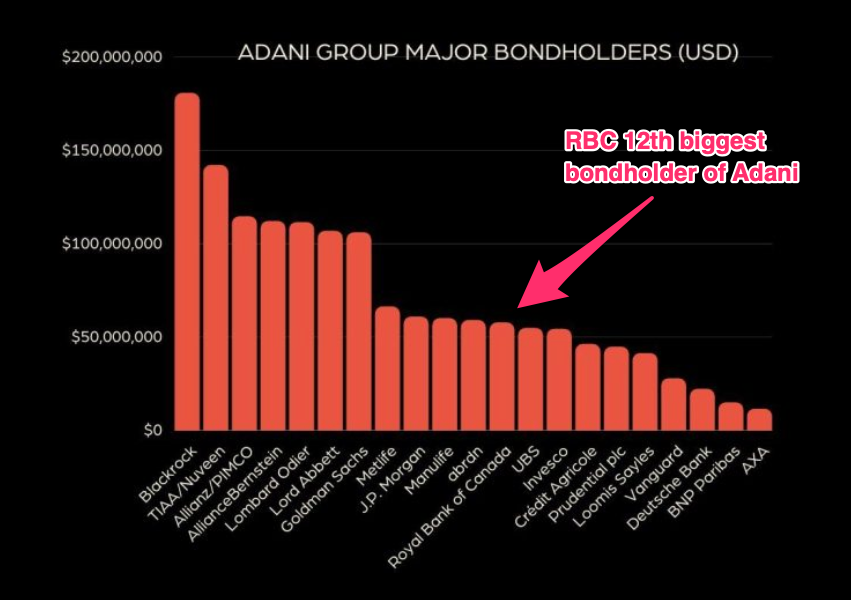

Adani’s coal expansion is being increasingly funded by global bond investors, with Adani now the largest Indian issuer of foreign denominated bonds with more than $8bn USD bonds presently outstanding. The Adani Group aims to raise an additional $10bn of debt this year, primarily via bonds. It’s inconceivable that major Adani bondholders and underwriters would touch this debt.

The #StopAdani movement, frontline Indigenous communities, and environmental and human rights advocates have been warning about Adani’s dodgy corporate behaviour for years, and have been calling on financial institutions to steer clear of Adani due to their coal expansion, climate change escalation and violation of human rights.

RBC Bank is the 12th biggest global bondholder of Adani. Learn more at ToxicAdaniBonds.com.