Annual report shows Canada’s big 5 banks increased support for fossil fuels by 70% in 2021

Canada’s major banks’ support for the fossil sector grew by 70% last year, despite recognizing the need for emissions to fall, according to the flagship report. Alarmingly, tar sands,(Canada’s fastest-growing source of carbon pollution) saw a 51% increase in financing from last year to $23.3 billion CAD, with the biggest jump coming from RBC and TD.

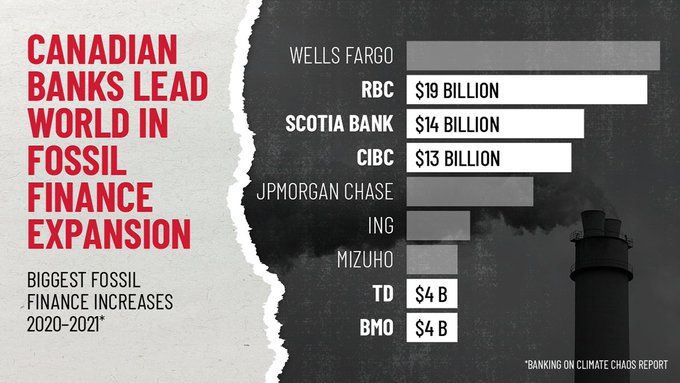

The 13th edition of the Banking on Climate Chaos report shows that RBC, Scotiabank, CIBC, TD, and Bank of Montreal all increased their financing of fossil fuels by a combined USD 54 billion (CA $61 billion with exchange rate shifts) in 2021, a 70% increase over 2020. Between 2016 and 2021, Canadian banks have funneled an alarming CA$ $911 billion into coal, oil, gas, and tar sands. Just last year, all of Canada’s banks vowed to become ‘net-zero’ by 2050 – pledging to reduce financed emissions to zero, including offsetting measures – yet in that very same year they provided $165 billion to fossil fuel clients.

The data shows Canadian banks are responsible for the largest increase in financed emissions globally. The figures were assessed by a consortium of civil society organizations including Rainforest Action Network, BankTrack, Indigenous Environmental Network, Oil Change International, Reclaim Finance, Sierra Club, and urgewald.

RBC remains top of the list as Canada’s worst offender of fossil fuel funding. The bank increased its funding by $23 billion last year, doubling its funding from the year before. This is followed by Scotiabank whose fossil fuel funding increase stands at $16 billion, with CIBC’s at $15 billion. TD and Bank of Montreal boast increases of $4 billion and $3 billion respectively.

“In light of RBC’s increased financing of fossil fuels over the last year, climate commitments without actual follow-through is just more hot air. We are incredibly disappointed that RBC is choosing to light our future on fire instead of being a climate champion,” said Sarah Beuhler, Stand.earth Senior Climate Finance Campaigner.

The report digs into the funding that 60 global banks provide to major fossil fuel companies and projects, which are the leading cause of climate change. Researchers found that fossil fuel financing from these banks has topped $5.998 trillion in the six years since the adoption of the Paris Agreement, with $939.67 billion in 2021 alone.

Canadian banks continue to be over-represented in the dirty dozen top fossil bankers since the Paris Agreement was signed, with RBC, Scotiabank, and TD all in the top twelve and all of the big five banks in the top 20. However, US banks continue to be the single worst grouping of fossil banks, with the top four fossil fuel funders in the world (JPMorgan Chase, Citi, Wells Fargo, and Bank of America) all US-headquartered, joined by Morgan Stanley and Goldman Sachs in the top 14.

Canadian banks are exposing shareholders and the public to unacceptable risk.” said Adam Scott, Director of Shift Action for Pension Wealth Planet Health, “They are risking the long-term value of their company with their dangerous over-dependence on lending to a fossil fuel industry facing sudden disruption. And they are risking our collective future by actively delaying the transition away from fossil fuels needed to stop the climate crisis. The data shows Canadian banks are responsible for the largest increase in financed emissions globally.”

Meanwhile, Europe is heading in the right direction with banks like La Banque Postale in France publishing a commitment in 2021 to end financing for all companies expanding oil and gas and exit the sector completely by 2030. Banks such as Crédit Agricole and Nordea have made similar commitments on coal.

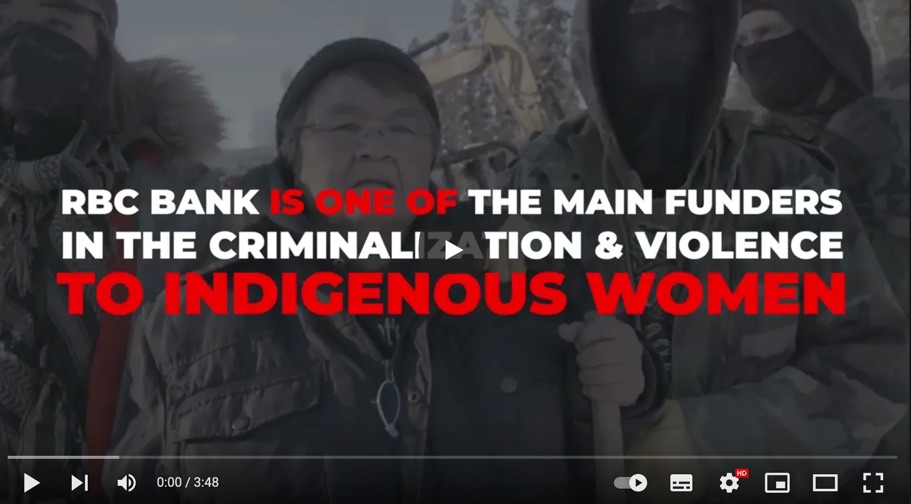

The Russian-Ukraine war has put a spotlight on the role that fossil fuels play in war. The Kremlin gets 36% of its budget to fund this war from the sale of oil and gas. Recent research revealed over $110 million USD invested by prominent Canadian financial institutions in Russian oil and gas majors Lukoil, Rosneft, and Gazprom. Banks that continue to fund the expansion of the whole sector are complicit in conflict and violence. Canada is no exception, with well-documented aggression against Indigenous resistors of the Coastal GasLink pipeline, principally funded by RBC.

This month, over 65 celebrities, musicians, and actors including Mark Ruffalo, Scarlett Johansson, and Leonardo DiCaprio called on RBC, Canada’s largest bank, to stop financing the pipeline and end fossil fuel finance once and for all.

“It’s incredibly alarming that in 2022 at the height of the climate crisis, RBC is doubling down on fossil fuel finance. I spoke at RBC’s shareholder meeting in 2009 to address water and climate impacts from RBC investments – yet RBC continues to willfully finance destruction, including in my community through the tar sands, the dirtiest fossil fuel in the world,” said Melina Laboucan-Massimo, Senior Director, Indigenous Climate Action. “This report is the latest example of RBC covering up their role in exacerbating the climate crisis, violating Indigenous rights by not upholding free, prior and informed consent as outlined in UNDRIP. In my community, we can’t drink our water because of RBC’s investments. We want to make sure communities elsewhere still can.”

It is only because of financing from banks and other financial institutions that coal, oil, and gas companies can continue to expand and increase their emissions. The goal to reduce emissions’ to safe and liveable levels will be unreachable. According to the UN’s Intergovernmental Panel on Climate Change (IPCC) report, the impact of global warming has intensified and the world is already facing irreversible damages in the ecosystem with both humans and animals struggling to survive.

“If money talks, then Canada’s big five banks are saying they want the planet to burn, baby, burn,” said Keith Stewart, senior energy strategist with Greenpeace Canada. “Their fossil fuel funding is back to pre-pandemic highs, which reveals all their fine words about climate action as mere sound and fury, signifying nothing.”

Today’s report comes ahead of fossil banks’ shareholder meetings, including RBC’s April 7 meeting where communities are gearing up to take action.