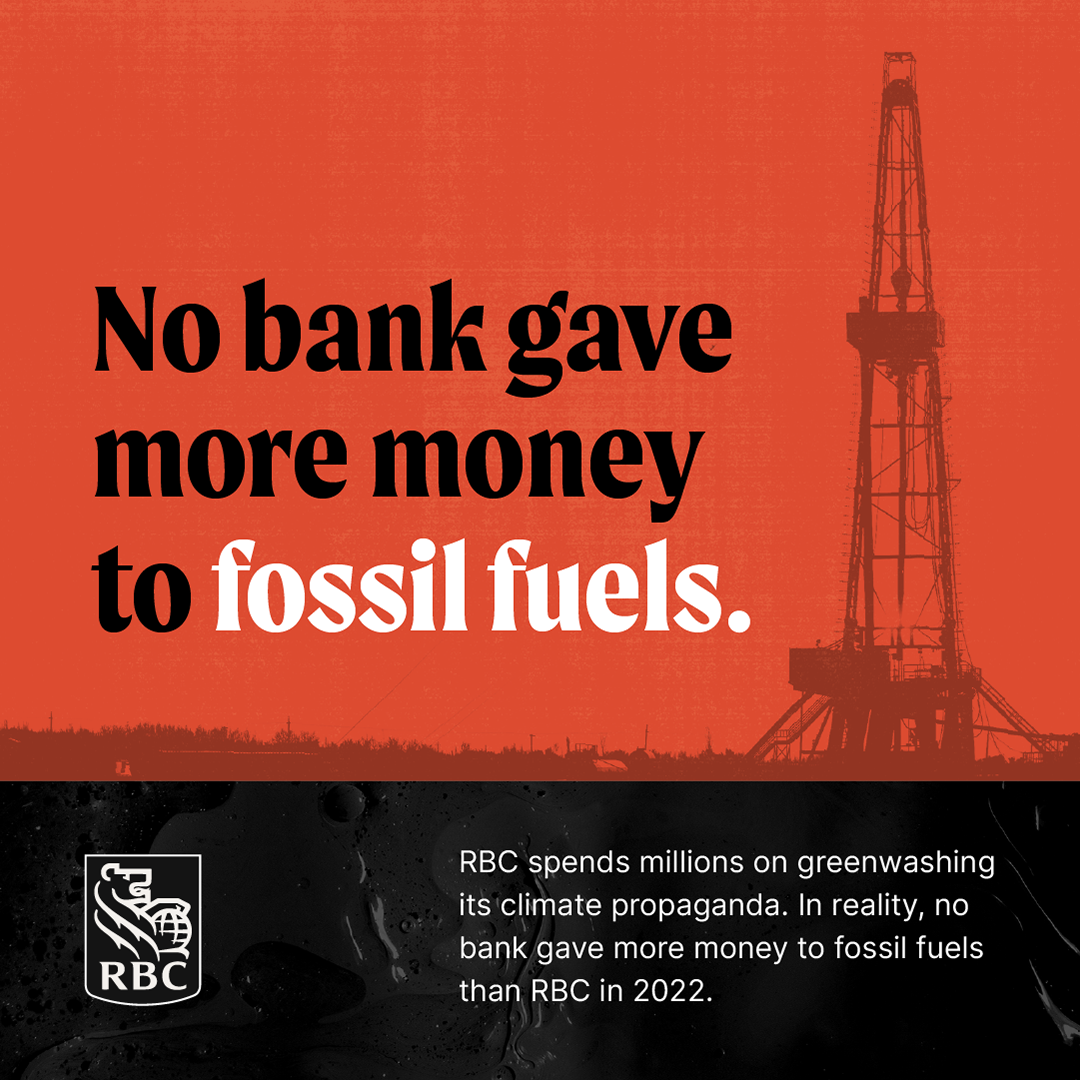

RBC named as world’s #1 fossil fuel financier

Released today, the 14th annual Banking on Climate Chaos report, the most comprehensive global analysis on fossil fuel banking, unveils Royal Bank of Canada as the world’s #1 fossil fuel financier in 2022.

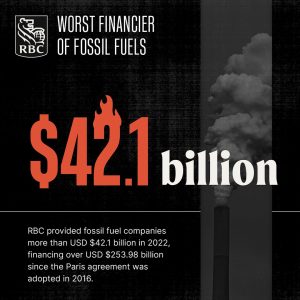

RBC pumped over USD$42.1 billion in 2022 in fossil fuel companies in the last fiscal year – an increase over 2021 levels. In total, since the Paris Climate Agreement was adopted in 2016, RBC has financed more than USD $253.98 billion to fossil fuel companies.

Total overall financing of fossil fuel companies by Canadian banks increased in 2022 over 2021 levels, surpassing USD $137 billion – the largest amount since before the Paris Climate Agreement was signed.

More information on Canadian Banks fossil fuel financing here.

| Bank | Fossil funding 2022 (USD / CAD billions) | Global Annual Rank 2022 | Global Annual Rank 2016 – 2021 |

| RBC | 42.1 / 54.7 | 1 | 5 |

| Scotiabank | 29.5 / 38.4 | 7 | 9 |

| TD | 29.0 / 37.7 | 8 | 10 |

| BMO | 19.3 / 25.1 | 13 | 15 |

| CIBC | 17.9 / 23.3 | 14 | 19 |

| TOTAL | 137.8 / 179.2 |

Public pressure is mounting on RBC – Canada’s, and now the world’s – #1 fossil fuel financing bank, to stop funding fossil fuel expansion and ramp up investments in climate-safe solutions.

At its Annual General Meeting (AGM) in Saskatoon just last week, RBC proved it has no interest in Indigenous reconciliation, furthering corporate colonialism in how the bank treated the Indigenous and Black delegation. The bank opted to apply a reserve system to its AGM, forcing Indigenous and Black delegates into a second class room, with color-coded passes.

Outside the AGM, hundreds of Indigenous water protectors, young people, and allies rallied. RBC’s AGM comes weeks after a large force of RCMP C-IRG raided a Gidimt’en village site, and arrested five land and water defenders, mostly Indigenous women. Days earlier, thousands of people took action for Fossil Fools Day at over 40 actions outside RBC branches across so-called Canada.

The day before its AGM, just as RBC re-packaged existing staff into a new climate institute to do “thought leadership” on climate, reports revealed that RBC helped arrange US$5.4B of ‘sustainability-linked’ financing for a coal mine operator in Germany, and traditional owners lodged a human rights lawsuit against 12 banks – including RBC – for involvement in a $4.7 billion gas project in Australia.

Despite net-zero commitments and public rhetoric, RBC continues to finance fossil fuel expansion, including bankrolling dangerous projects that attack Indigenous sovereignty, like the Coastal GasLink fracked gas pipeline without consent from Wet’suwet’en Hereditary leadership. Many of RBC’s oil and gas clients increased overall emissions in 2022.

RBC is currently under investigation by the Competition Bureau of Canada for allegedly misleading consumers with climate-related advertising while continuing to increase financing for coal, oil and gas.

The report and RBC’s new role as the world’s worst bank on climate was covered by over 500 global media outlets, including:

- Axios Generate: Number of the day: $673 Billion By Ben German and Andrew Freedman

- Barron’s Banks Keep Pouring Cash Into Fossil Fuels. US Lenders Lead the Way. By Lauren Foster

- Bloomberg: RBC Becomes World’s Biggest Fossil Fuel Bank, Topping JP Morgan By Kevin Orland

- CTVNews: RBC biggest fossil fuel funder globally in 2022 at US$42B: report

- Environmental Finance: Japan’s Largest Banks Hit By Shareholder Climate Action By Genevieve Redgrave

- Euro News.green: BNP Paribas, Barclays: Europe’s biggest fossil fuel financiers – and who to bank with instead By Lottie Limb

- Financial News: Largest global banks provide $673bn to fossil fuel industry By Lauren Foster

- Financial Post: RBC tops list of global financiers to fossil fuel companies in 2022, says report by environmental groups By Barbara Shecter

- Financial Times: Royal Bank of Canada Becomes Top Financier for Fossil Fuel Industry By Attracta Mooney, Camilla Hodgson, Patrick Temple-West

- Global News Ca: Canadian Bank Reported as biggest fossil fuel funder in the World

- Marketwatch: Banks Keep Pouring Cash Into Fossil Fuels. US Lenders Lead the Way. By Lauren Foster

- Morning Star: North American Morning Briefing Provided by Dow Jones

- National Observer: RBC was the world’s top funder of fossil fuels in 2022, by John Woodside

- InsideClimate: Banks Say They’re Acting On Climate, But Continue to Finance Fossil Fuel Expansion By Nicholas Kusnetz

- Reuters: France’s Credit Mutuel to stop financing energy groups that aren’t cutting oil and gas output

- Sierra Magazine: Canada’s RBC Tops List of Banks Financing the Climate Crisis By Jonathan Hahn

- Yahoo! Finance: RBC surpasses JP Morgan in global fossil fuel financing in 2022: report By Jeff Lagerquist

Fossil Fuel Sector Trends (in USD)

Expansion: The 60 banks profiled in this report funneled $150 billion in 2022 into the top 100 companies expanding fossil fuels, including TC Energy, TotalEnergies, Venture Global, ConocoPhillips, and Saudi Aramco.

Liquefied Natural Gas (LNG): The top bankers of liquefied “natural” gas (LNG) in 2022 were Morgan Stanley, JPMorgan Chase, Mizuho, ING, Citi, and SMBC Group. Overall finance for LNG nearly doubled from $10.8 billion in 2021 to $21.3 billion in 2022.

Tar sands oil: The top tar sands companies received $21 billion in financing in 2022, led by the biggest Canadian banks, who provided 89% of those funds. TD, RBC, and Bank of Montreal top the list.

Arctic oil and gas: Chinese banks ICBC, Agricultural Bank of China, and China Construction Bank led financing for Arctic oil and gas, which totaled $2.9 billion for the top companies in this sector in 2022. 26 banks are still financing Arctic oil and gas, including U.S. banks JPMorgan Chase, Citi, and Bank of America.

Amazon oil and gas: Spanish bank Santander leads financing for companies extracting in the Amazon biome, followed closely by U.S. bank Citi. Financing totaled $769 million in 2022.

Fracked oil and gas: Finance for the fracking companies totaled $67.0 billion dollars in 2022, which is an 8% increase over the financing reported in 2021 for the top fracking companies. This increase is especially disturbing given the extreme methane emissions from fracking. RBC and JPMorgan Chase are the top financiers of fracked oil and gas for 2022/since Paris.

Offshore oil and gas: European banks BNP Paribas, Crédit Agricole, and Japanese bank SMBC Group top the list of worst financiers of offshore oil and gas for 2022. Financing totaled $34 billion in 2022.

Coal mining: Of the $13.0 billion in financing that went to the world’s 30 largest coal mining companies, 87% was provided by banks located in China, led by China CITIC Bank, China Everbright Bank, and Industrial Bank.

Coal power: Of the financing to the world’s top 30 companies in coal power, 97% of financing was provided by Chinese banks. These companies, which have plans to expand coal power capacity, received $29.5 billion from the profiled banks in 2022.

Full data sets – including global press materials, fossil fuel finance data, policy scores, and stories from the frontlines – are available at bankingonclimatechaos.org.