Never believe a bank’s net zero pledge

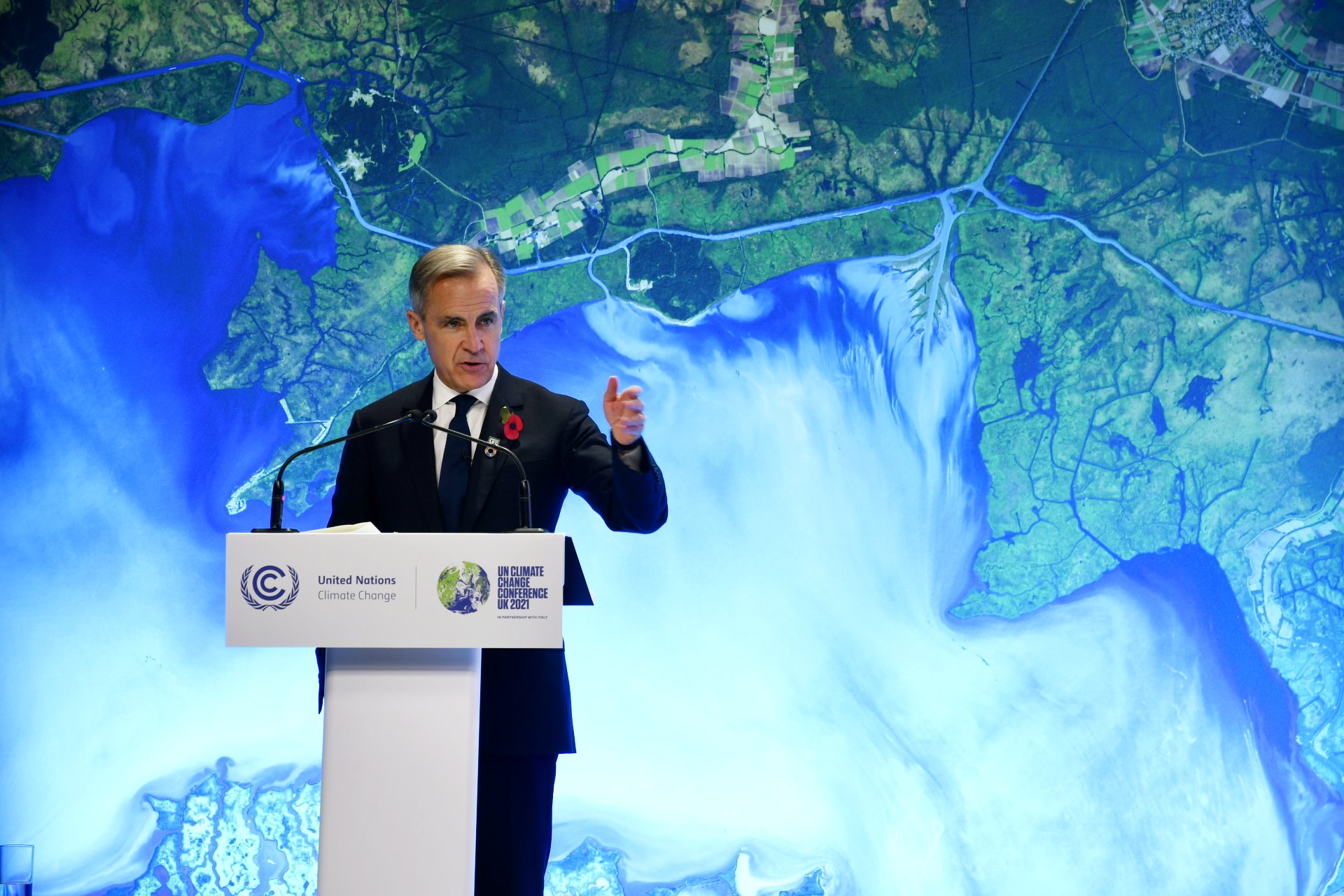

A new report out this week by a European NGO tracks how banks continue to fund the expansion of fossil fuels, even after signing onto Mark Carney’s high profile Net Zero Banking Alliance last year.

Why is this a problem? All of the climate science projections and even the International Energy Agency’s most recent energy analysis shows that the planet can afford no new fossil fuel expansion while keeping global warming to under 1.5 degrees C. The expansion simply must stop.

But banks are clearly not getting the memo. Kate Aranoff, writing in the New Republic this week, summarizes:

A new report from the U.K.-based charity ShareAction finds that 25 European NZBA members have provided at least $38 billion in financing to 50 of the most expansionary upstream oil and gas companies on earth. Half of that financing was provided by four of the founding signatories of the Alliance: Barclays, BNP Paribas, Deutsche Bank, and HSBC. Since the Paris Agreement was brokered in 2016, the European banks analyzed have furnished upstream oil and gas expanders with $400 billion, and they “show no signs of stopping”.

She goes on to report:

Just as European oil companies have been quicker to announce net-zero pledges than U.S. companies, European banks have generally been more forthcoming with climate commitments. But talk doesn’t always translate to action: Just five of the European banks analyzed have begun to restrict financing for oil and gas projects, while only one—La Banque Postale—has a defined phaseout plan, to exit the oil and gas sector by 2030.

Others have been more canny: Barclays, for instance, pledged to cut off financing for shale drilling in Europe and the U.K. but not the U.S. “It’s a trend with a lot of bank policies,” Shields said of the Barclays pledge. “They have great headlines to go out with, but once you drill down into the policies, you see these big exceptions. A huge number of those exceptions allow them to continue business as usual.”

While the report is focused on European banks, Canadian banks – who joined Carney’s Net Zero Banking Alliance all at once and right at the last minute before the Glasgow COP – are even worse at funding expansion. Expect new numbers from RBC and the rest of the dirty Canadian banks next month when the latest Banking on Climate Chaos figures are out.