The problem with Coastal GasLink and RBC

Coastal GasLink (CGL) is a dangerous project that blatantly violates Indigenous rights, and puts our climate goals at risk. Our partners Stand recently published a detailed case study on the problems with CGL.

Built by TC Energy, the 670-km Coastal GasLink pipeline is intended to carry fracked gas from Dawson Creek to Kitimat, BC, where it will be converted to liquified natural gas (LNG) for export to global markets. Despite unequivocal Wet’suwet’en opposition to the project, the pipeline runs through 22,000 square kilometres of the Nation’s unceded territory. It also crosses more than 206 ecologically sensitive waterways. The pipeline is built to carry 2.1 billion cubic feet per day of fracked gas, with a peak capacity of up to five billion cubic feet per day.

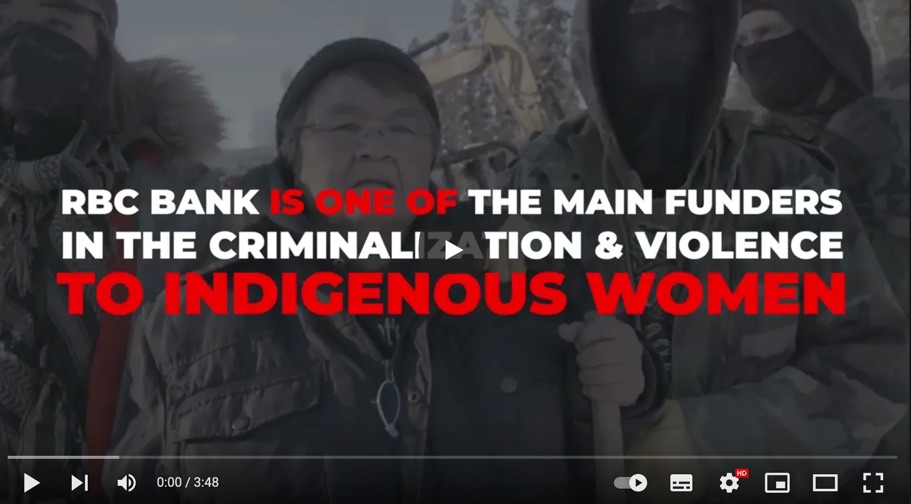

The Royal Bank of Canada (RBC) is among five commercial banks (including Bank of Montreal, Scotiabank, CIBC and TD bank) that provided the project with working capital. RBC provided CAD $275 million in project finance – including a co-financed $6.5 billion loan and a $40 million corporate loan, and $200 million in co-financed working capital – while acting as financial advisor for the pipeline.

RBC also holds over 85 million shares in TC Energy, which translates to about 8.6% of the company or more than a $1.03 billion-dollar stake (at $58/share). RBC not only finances TC Energy; it’s deeply invested in the company, and doubly exposed in the Coastal GasLink pipeline.

Read the full case study on the Stand website.