New report: Canadian banks defying climate science by increasing fossil fuel finance

Canadian banks are playing a growing and globally significant role in fueling climate destruction and are more exposed to climate risk than they are telling their shareholders according to data in a new Greenpeace report. The report finds that prior to the pandemic, Canadian big 5 banks steadily increased their fossil fuel loans and investments since the Paris Climate Agreement was signed.

This post was originally published on the Greenpeace Canada website.

TORONTO – Canadian banks are playing a growing and globally significant role in fueling climate destruction and are more exposed to climate risk than they are telling their shareholders according to data in a new Greenpeace report. The report finds that prior to the pandemic, Canadian big 5 banks steadily increased their fossil fuel loans and investments since the Paris Climate Agreement was signed.

“The UN Secretary General said that the latest IPCC climate science report should be a ‘death knell’ for fossil fuels, but Canadian banks are still providing hundreds of billions of dollars to keep oil, gas and coal companies alive. Canadian banks have provided over thirteen times more financial support to the fossil fuel industry than the federal government has spent on its plan to meet its Paris climate commitments, with no end in sight,” said Keith Stewart, senior energy strategist with Greenpeace Canada. “If bankers won’t read the IPCC report, then they should step outside and smell the smoke from climate-fueled wildfires and recognize that they have a choice: stop funding fossil fuels or go down in history as planetary arsonists.”

The report was commissioned by Greenpeace Canada from the consultant firm Profundo, contributors to the annual “Banking on Climate Chaos” report.

Key findings of the report include:

- Canadian Banks have provided almost CAD $700 billion to companies active in the fossil fuels sector since the signing of the December 2015 Paris Climate Agreement in the form of loans ($477 billion) and underwriting services ($216 billion).

- Canadian banks also hold $125 billion in fossil fuel shares and bonds, and the number of shares they hold has been rising.

- This $819 billion in loans ($694 billion) and investments ($125 billion) is over 13 times greater than the $60 billion the federal government has invested in climate action and clean growth since 2015.

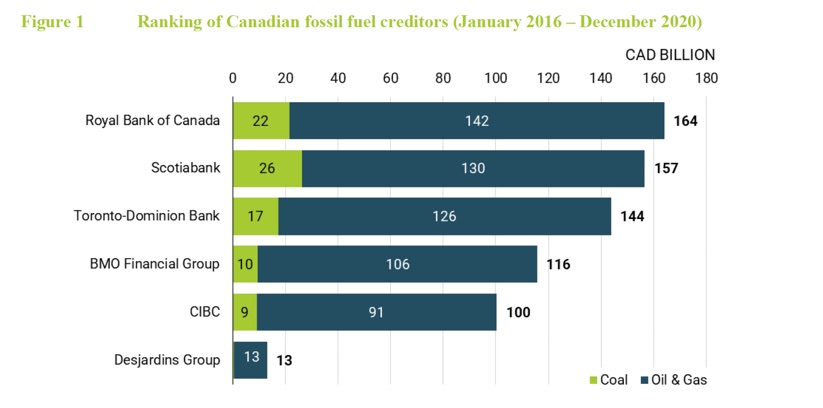

- All of Canada’s big 5 banks are in the top 25 of global banks financing fossil fuels. Amongst the six banks in the study, RBC is the largest financier of fossil fuels, followed by Scotiabank, TD, BMO, CIBC and then the Desjardins Group (DG).

- The bulk of the loans and underwriting ($609 billion, or 88% of total) went to oil & gas companies. Coal companies received the other 12% of the total ($84.8 billion). Enbridge was the largest recipient, followed by CNRL, TransCanada and Cenovus.

- Fossil fuel financing rose from $122 billion in 2016 to $160 billion in 2019, before dropping by 30% in 2020 due to the pandemic.

- Profundo’s analysis of the banks’ exposure to losses from a decline in the value of fossil fuel companies consistent with achieving a 1.5 degree scenario is larger than what they self-report (a 130 basis points decline on average in this analysis versus 57 basis points in their published materials).

- Outstanding loans to oil & gas firms account for around half of the Common Equity Tier 1 Capital (a key indicator of financial stability) for BMO (54%), CIBC (49%) and Scotiabank (45%). Oil & gas loans are also significant for TD (35%) and RBC (29%) but less so for DG (13%). Exposure to the broader fossil fuel industry is even more significant, accounting for around 55-60% of Common Equity Tier 1 (CET 1) Capital for BMO, Scotiabank and CIBC; around 40% for TD and RBC; and 17% for DG.

- While fossil fuel companies are major clients of Canadian banks, this relationship is not “too big to fail”. The banks can eliminate the risk of stranded assets by phasing out their support for fossil fuels. And all of the banks currently have capital reserves roughly double what is required by regulators, so even in a 1.5-degree scenario the impact of the loan defaults by fossil fuel companies would not, on their own, put the banks in breach of those requirements.

The federal bank regulator (the Office of the Superintendent of Financial Institutions – OSFI) is currently reviewing banks’ exposure to climate risk, and Greenpeace Canada is calling on the government to regulate them rather than rely on the bankers’ goodwill.

Most of Canada’s big 5 banks have made a public commitment to achieve net-zero emissions by 2050. The International Energy Agency has said that achieving this goal requires that there be no new investments in fossil fuels and an accelerated phase-out of existing fossil fuel operations.

– 30 –

The full report can be found here.